Climate Change

Basic Concept

Since our Group is engaged in businesses that consume a large amount of energy during manufacturing, there is a risk that various regulations and systems (carbon pricing, etc.) associated with the Paris Agreement, etc. will lead to higher costs for energy and raw materials. We also believe that the occurrence of natural disasters due to extreme weather phenomena in recent years will lead to risks such as the instability of business continuity and supply. On the other hand, we also believe that the growing awareness of climate change among society and customers provides an opportunity for our low-carbon, resource-recycling steel products to gain a competitive advantage.

Domestic 2030・2050 Environmental Vision / Medium-term Sustainability Plan

Response to TCFD Recommendations

In April 2022, the Yamato Kogyo group endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD was established by the Financial Stability Board (FSB), whose members include representatives of central banks and financial supervisors from 25 major countries and regions, and its recommendations for companies and organizations to disclose information on climate-related risks and opportunities. In Japan, the Ministry of Economy, Trade and Industry (METI) has published the "Guidance on Climate-related Financial Disclosures (TCFD Guidance)”, and companies have been accelerating their efforts to comply with the TCFD recommendations. In addition, the "Corporate Governance Code" revised by Japan Exchange in June 2021 also requires listed companies to disclose information based on the TCFD framework.

In light of the impact of climate change on our business, the Management Committee and Sustainability Committee of the Yamato Kogyo group have been considering climate change countermeasures in our domestic business since the FY2021. The following are the disclosures related to climate change based on the TCFD recommendations approved by the Board of Directors in April 2022.

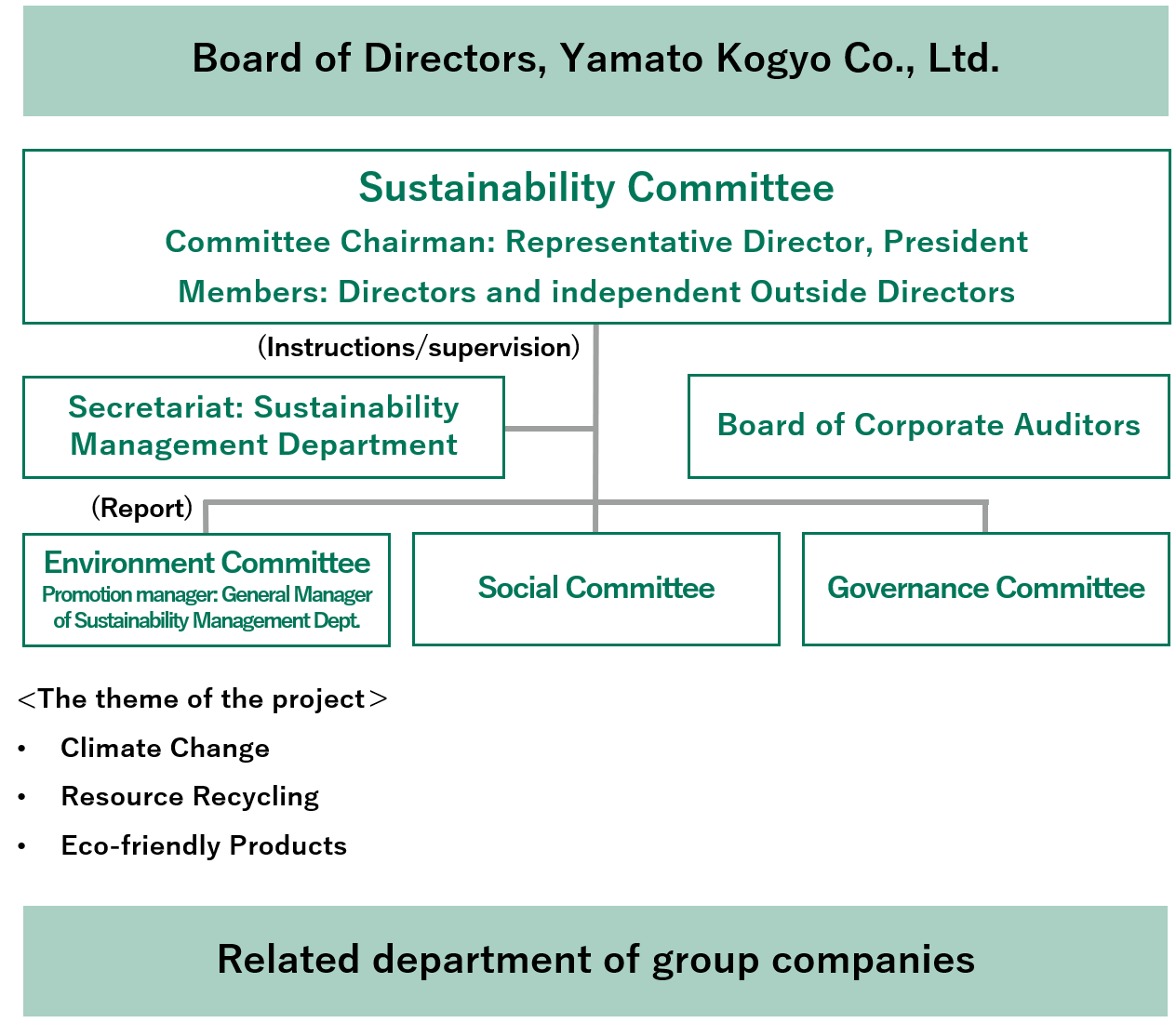

Climate Change-related Governance Structure

Our group reports to the Board of Directors of Yamato Kogyo Co., Ltd. on a case-by-case basis on matters related to climate change issues discussed by the Environment Committee of the Sustainability Committee that meets regularly.*1 When considering business plans and annual budgets, the Board of Directors makes decisions based on the impact of climate change on business management, including risks and opportunities. The Board of Directors also checks and supervises the targets and progress regarding climate change, which the Sustainability Committee has designated as materiarity of the Medium-term Sustainability Plan.

The Sustainability Committee is chaired by Representative Director, President of Yamato Kogyo, and the Environment Committee is led by the General Manager of Sustainability Management Department.

*1 Normally held once or twice a year, four times in FY2024.

Climate Change-related Governance Structure

Risk Management Related to Climate Change

Our group classified climate-related risks in its operations into migration risks and physical risks following the TCFD recommendations, and further assessed the risks by examining their materiality in consideration of short, medium, and long-term time horizons and relevant laws and regulations. The risk assessment was determined after review and discussion at a Management Committee attended by directors and corporate auditors.

Climate Change Related Strategies

<Assumptions for scenario analysis>

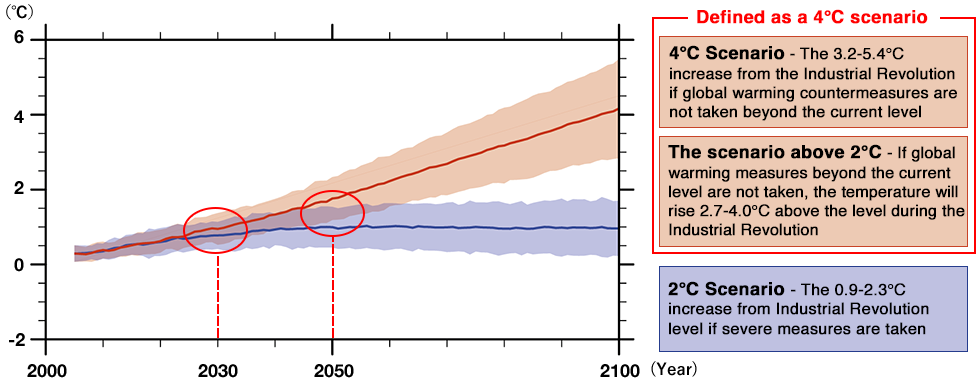

In our scenario analysis, while taking into account the Paris Agreement’s goals and the IPCC Sixth Assessment Report, we examined two scenarios: a 2℃ scenario, which is a low-carbon transition scenario, and a 4℃ scenario, which projects higher warming outcomes and more significant physical impacts. In light of the Paris Agreement's goal of "pursuing efforts to limit the increase in global average temperature to 1.5℃ above pre-industrial levels," we will continue to study transition scenarios toward the 1.5℃ goals.

Global Average Surface Temperature Change (Relative to 1986-2005)

Source: IPCC Fifth Assessment Report

<Scope of scenario analysis>

The scenario analysis is based on the Japanese government's greenhouse gas reduction targets (46% reduction by FY2030 and carbon neutrality by FY2050) and is conducted over a medium to long-term time horizon to 2050.

- ① Japan (domestic)

- ② Risks and opportunities associated with climate change that are likely to impact our business

- ③ Potential climate change impacts across the value chain as the scope of analysis

The analysis at this time is as follows.

Climate Change-related Scenario Analysis

| Scenario | Factor | Impact on Yamato Kogyo Group | Responding to Risks/Opportunities/Impacts | |

|---|---|---|---|---|

| 2℃*2 | Factor (1) Increasing demand for products that promote customer/society's effort in decarbonization and climate change The competitive environment will change as responses to climate change expand throughout the value chain and low environmental impact products and companies that tackle environmental issues are selected Infrastructure construction for disaster prevention and mitigation will proceed slowly |

|

|

|

|

|

|

||

| Factor (2) Carbon pricing Various costs such as retail electricity prices will increase due to policies and regulations (carbon pricing) |

|

|

|

|

| Factor (3) Shift of blast furnaces to electric furnaces The shift of blast furnace makers to electric furnaces will affect the procurement of raw materials, sub-materials, and energy |

||||

| Factor (4) Increasing social demands Increasing social demand for CO2 reductions will be driving a shift in materials and production processes toward low-carbon/decarbonization |

|

|

|

|

|

|

|

||

| 4℃*3 | Factor (5) Intensification of natural disasters Physical risks (flooding, property damage) at our sites and sales/procurement logistics network will become apparent Prevention and response will increase costs Heat stress during work reduces productivity and regulations will be tightened in response |

|

|

|

| Factor (6) National Resilience Disaster prevention and mitigation plans will be revised and government-led disaster response to infrastructure, etc., will spread |

|

|

|

|

*2 2℃ scenario: A scenario in which the necessary measures are taken to limit the temperature increase to 2℃ or lower compared to the time of the Industrial Revolution period.

*3 4℃ scenario: A scenario in which no special measures are taken against climate change and the average temperature increases about 4℃.

<Opportunity initiatives>

Expansion of competitive advantage – market expansion

In Japan, the movement toward achieving carbon neutrality by 2050 is accelerating, and we expect that our customers in the construction and transportation industries will increase their procurement of products that contribute to low carbon emissions. Against this backdrop, our group has been working to expand its market through industry-leading initiatives. For example, in the area of climate change, while electric furnace makers generally emit about a quarter of the CO2 emissions per ton of blast furnace makers in their steel manufacturing processes, Yamato Steel has been introducing rationalization equipment, including the adoption of a state-of-the-art single-stage preheater (SSP) in FY2019 that achieves significant energy savings. This has enabled us to reduce CO2 emissions per ton, giving us a competitive edge in the electric furnace industry. In addition, while the selection of companies that produce products with low environmental impact is expected to be selective, we have been the first in the domestic steel industry to obtain SuMPO EPD for our main products and to make our Climate Declaration publicly available. We will continue to address climate change and expand our market by capturing business opportunities through our competitive advantage.

See also below for our group's competitive advantages and initiatives in climate change.

Realizing a Circular Economy with Steel

<Risk initiatives>

Efficient energy use

A large amount of electric power is indispensable for our group's business. We recognize that future trends in energy policy and laws and regulations will have a significant impact on our operating costs if retail electricity prices increase. To date, our group has implemented a variety of initiatives for the efficient use of energy, ranging from the introduction of equipment to fuel conversion and the establishment of technologies. These efforts have produced results not only in terms of total CO2 emissions but also in terms of CO2 emission intensity per ton of crude steel produced. Against the backdrop of growing social demands for further decarbonization in the future, we believe that the following past, present, and future initiatives of our group will lead to risk reduction.

- ・Low NOx regenerative burner installed (since Mar 2001)

- ・Fuel conversion to LNG (since Jan 2006)

- ・Establishment of low-temperature operation technology for reheating furnaces (since 2013)

- ・Use of LEDs in plant facilities (since 2018)

- ・Introduction of single-stage preheater (SSP) (since Jan 2019)

- ・Establishment of dynamic control technology by introducing exhaust gas analyzers

- ・Use of renewable energy

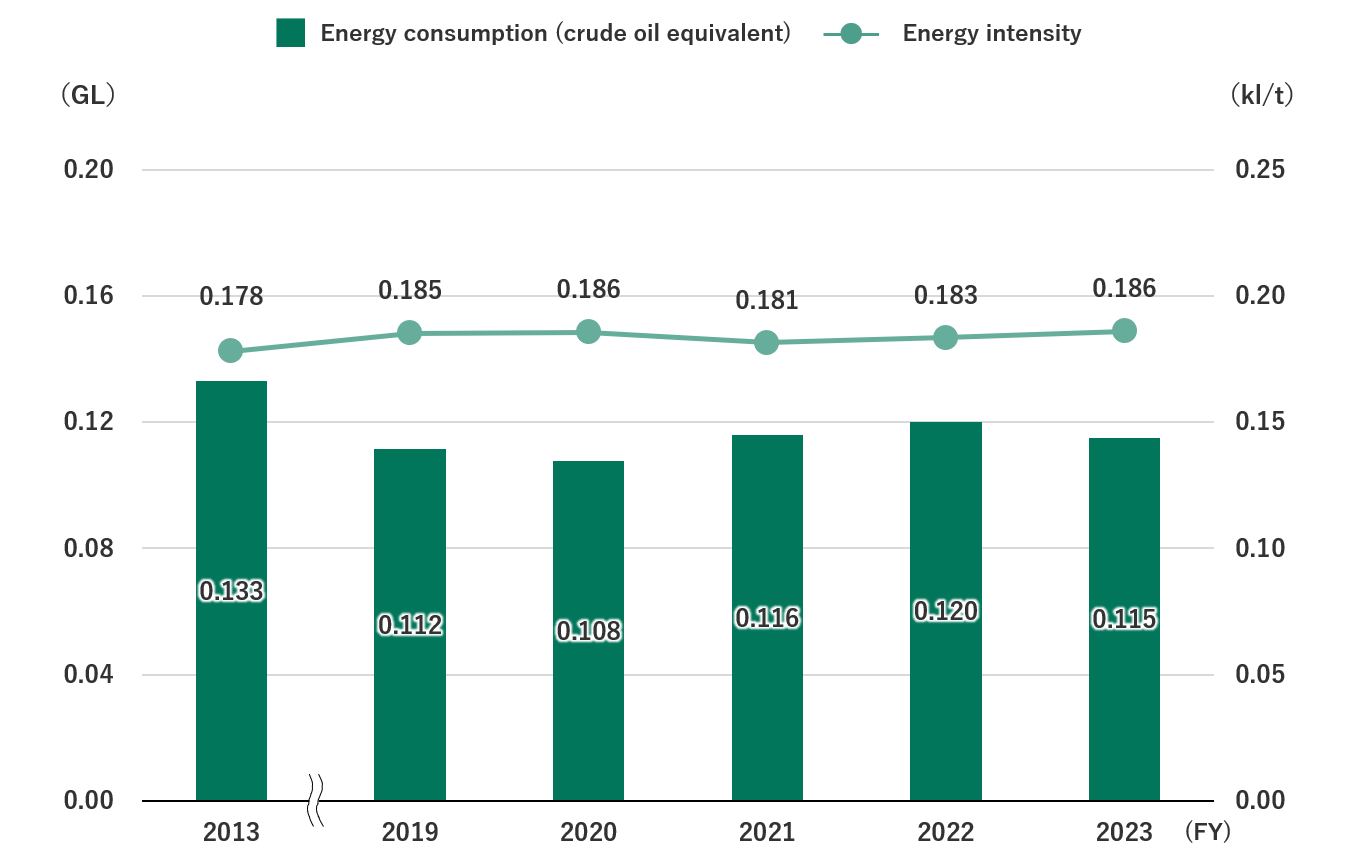

As a result of these efforts, energy consumption in FY2024 was 0.101 GL and energy intensity was 0.188 kL/t-crude steel production.

Energy Consumption and Intensity

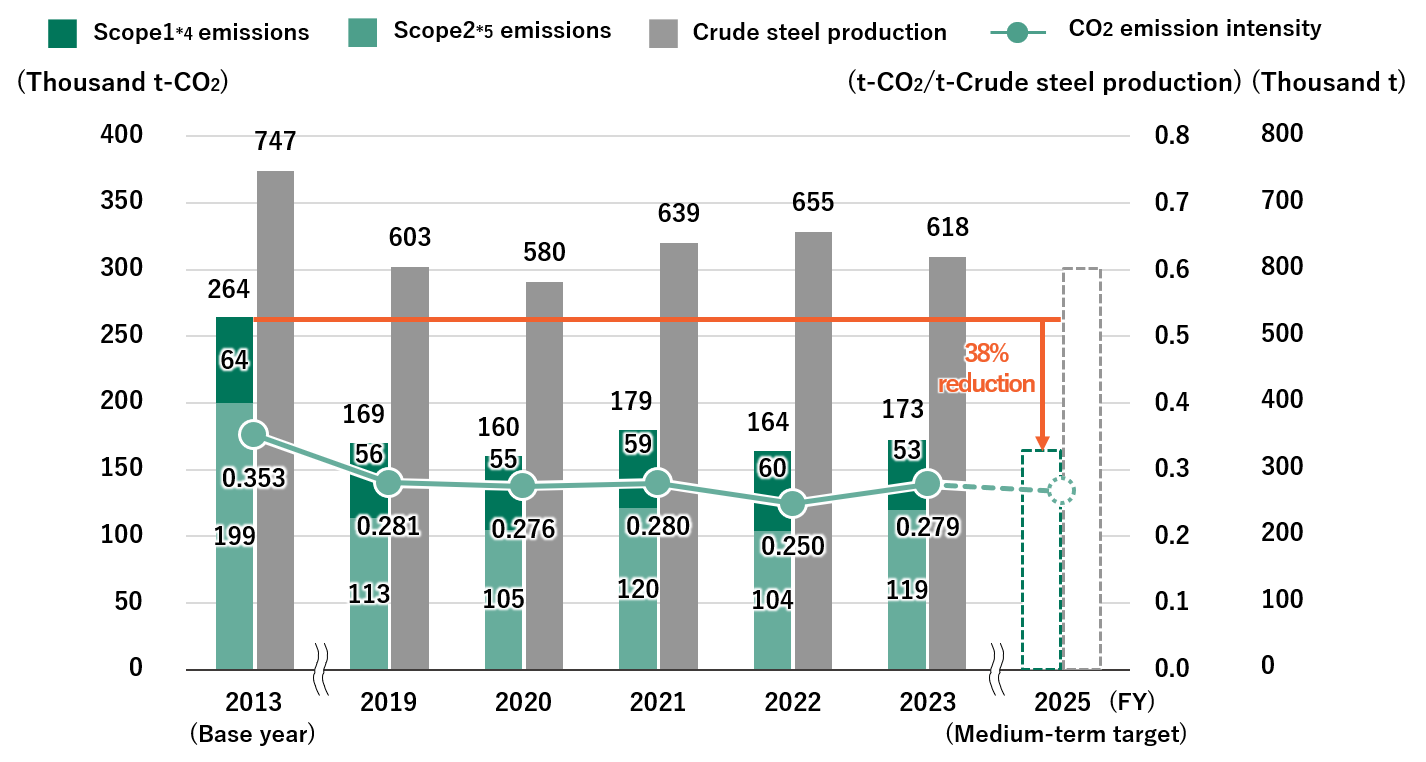

Indicators and Targets

Based on the scenario analysis, we set medium-term and annual targets as climate change-related indicators and targets in the Medium-Term Sustainability Plan, and the Sustainability Committee monitors and verifies progress and reports to the Board of Directors. The emissions reduction target has been set to a target of 38% reduction from the 2013 level for Scope 1 and 2, targeting 2025, taking into consideration the characteristics of our group's business, past initiatives, and future social trends.

Medium-term Sustainability Plan “Climate Change”

| Materiality | Item | FYE March 2026 | FYE March 2026 |

|---|---|---|---|

| Medium-term targets*4 | Annual targets*4 | ||

| Climate change | Response to Climate change risks | We will disclose to the market financial impact from transitional and physical risks relating to climate change in the period to FYE March 2026. |

|

| Reduction of greenhouse gases ("GHG") emissions | We will reduce CO2 emissions by 38% from the FYE March 2014 level.*5*6 |

|

|

| Efficient energy use | We will reduce CO2 emission intensity by 20% from the FYE March 2014 level.*5*6 |

|

|

| Use of renewable energy | We will introduce renewable energy in specified business areas by FYE March 2026. |

|

*4 Unless otherwise stated, descriptions under these items target iron and steel products business, that would have the greatest impact on Yamato Kogyo Group.

*5 To conform with the Japanese government's reduction targets, we use FYE March 2014 as the base year.

*6 Scope 1 and 2 total. Because the electric furnace business is characterized by heavy use of electric power, it would be significantly impacted by any change in the generation mix of electric power companies.

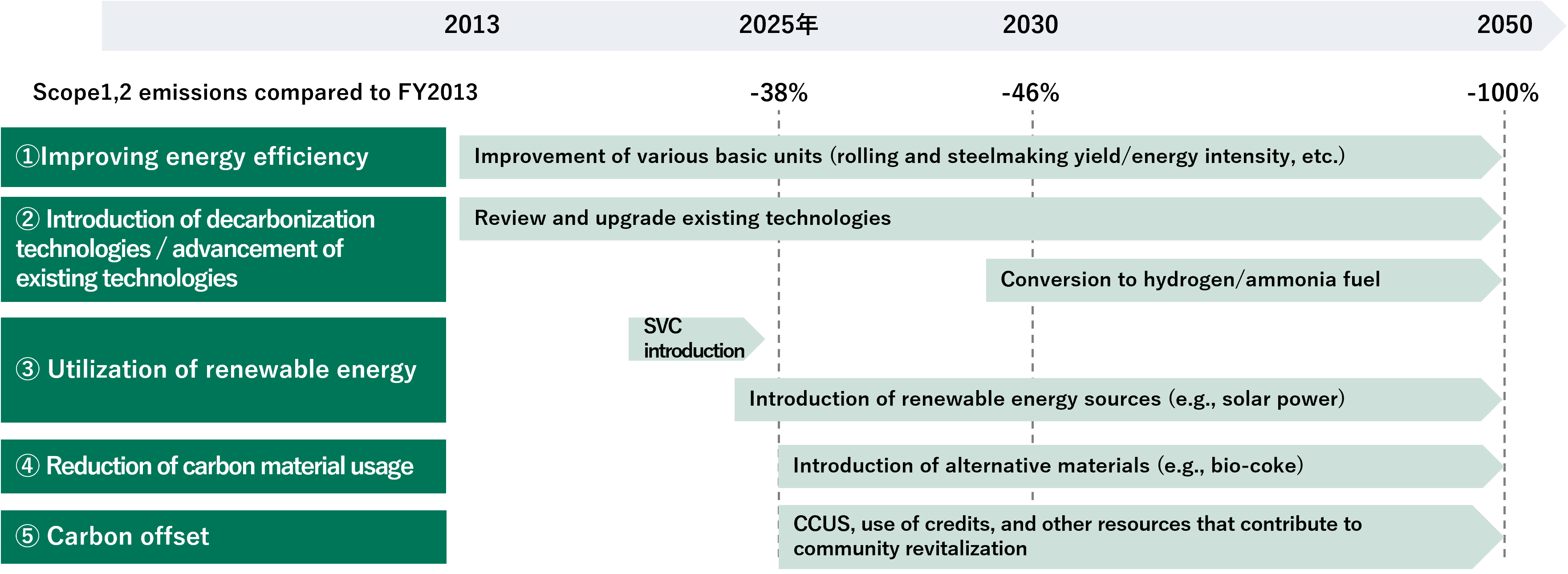

CO2 Emissions Reduction Achievements and Reduction Roadmap

We have established an Environmental Vision that challenges us to become carbon neutral by 2050 and to reduce CO2 emissions by 38% in 2025 and 46% in 2030 compared to fiscal year 2013 levels.

To achieve carbon neutrality, we will promote energy conservation and consider renewable energy, alternative materials (e.g., bio-coke), and CCUS (carbon capture, utilization and storage).

We are promoting multiple parallel initiatives to achieve the reduction targets set forth in our Environmental Vision.

In 2025, we plan to begin solar power generation and commence construction of a bio-coke production facility as a substitute for conventional coke. Through these and other initiatives, we expect to achieve our target.

CO2 Emissions, Reduction Achievements, and Targets

*7 Direct emissions from in-house fuel use and industrial processes

*8 Indirect emissions from the use of electricity and heat purchased by the company

(Note 1) Date cover domestic iron and steel products business. Because the electric furnace business is characterized by heavy use of electric power, it would be significantly impacted by any change in the generation mix of electric power companies.

(Note 2) Calculated base on METI, “Act on Rationalization of Energy Use and Shift to Non-fossil Energy” (the Energy Saving Law).

Roadmap toward Carbon Neutrality

Yamato Kogyo Group Greenhouse Gas (GHG) Emissions

Scope 1&2: GHG Emissions (FY2024)

(Unit: Thousand t-CO2e)

| Scope1 | Scope2 | Scope1+2 | |

|---|---|---|---|

| Steel business (Japan) | 91.21 | 121.66 | 212.87 |

| Trackwork system business | 0.05 | 1.66 | 1.71 |

| Other | 0.73 | 0.26 | 0.99 |

| Total domestic sites | 91.99 | 123.58 | 215.57 |

| Steel business (Thailand) | 113.87 | 185.67 | 299.54 |

| Total | 205.86 | 309.25 | 515.11 |

- The data covers the Company (Yamato Kogyo) and its five domestic and overseas consolodated subsidiaries (Yamato Steel, Yamato Trackwork System, Yamato Shoji, Matsubara Techno, and Siam Yamato Steel). The aggregation period follows the accounting period of each company.

- The Company and its domestic subsidiaries use the coefficient specified by the Act on Promotion of Global Warming Countermeasures, and calculate it by the Act on Rationalizing Energy Use.

- Siam Yamato Steel (SYS), a consolidated subsidiary in Thailand, calculates the coefficient and calculation method provided by TGO (Thailand Greenhouse Gas Management Organization).

- Since the Company has been using CO2-free electricity derived from renewable energy sources since October 2021, it is excluded from the calculation of Scope 2 emissions.

- SYS has higher emissions than domestic steel operations due to higher production volumes and larger emission factors.

Scope 3: GHG Emissions by Category(FY2024)

(Unit: Thousand t-CO2e)

| Category | Emissions | ||

|---|---|---|---|

| Yamato Steel | SYS | ||

| 1 | Purchased goods and services | 138.91 | 37.93 |

| 2 | Capital goods | 44.01 | - |

| 3 | Fuel-and energy-related activities not included in Scope1 or Scope2 | 30.96 | 57.68 |

| 4 | Upstream transportation and distribution | 14.64 | 19.36 |

| 5 | Waste generated in operations | 0.37 | 0.69 |

| 6 | Business travel | 0.05 | 0.06 |

| 7 | Employee commuting | 0.18 | 0.15 |

| 9 | Downstream transportation and distribution | - | 3.39 |

| 12 | End-of-life treatment of sold products | 0.73 | - |

| Total | 229.84 | 119.26 | |

- The calculation covers the domestic bases (Head Office and Factory, Tokyo Branch, and Osaka Branch) of Yamato Steel and SYS.

- The period of the calculation follows the accounting period.

- The calculation method is based on the Ministry of the Environment’s “Basic Guidelines for Calculating Greenhouse Gas Emissions through Supply Chains (ver. 2.7)” and “Emission Unit Database for Calculating Greenhouse Gas Emissions and Other Emissions of Organizations through Supply Chains (ver. 3.5)”, and the Institute of Advanced Industrial Science and Technology’s “LCA Database IDEA ver. 2.3 (for calculating supply chain greenhouse gas emissions).”

Third-Party Verification of GHG Emissions

For the purposes of accurately calculating emissions of the entire supply chain, quantitatively understanding the environmental impact and disclosing highly reliable and transparent data to stakeholders, Yamato Steel and SYS underwent verification of its Scope 1,2 and 3 emissions and obtained a third-party verification report.

Yamato Steel Greenhouse Gas Emissions Verification Report(PDF:1,876KB)

Use of Clean Energy Sources

As a company that consumes a lot of electricity, our group is promoting the increased use of clean energy sources such as renewable energy.

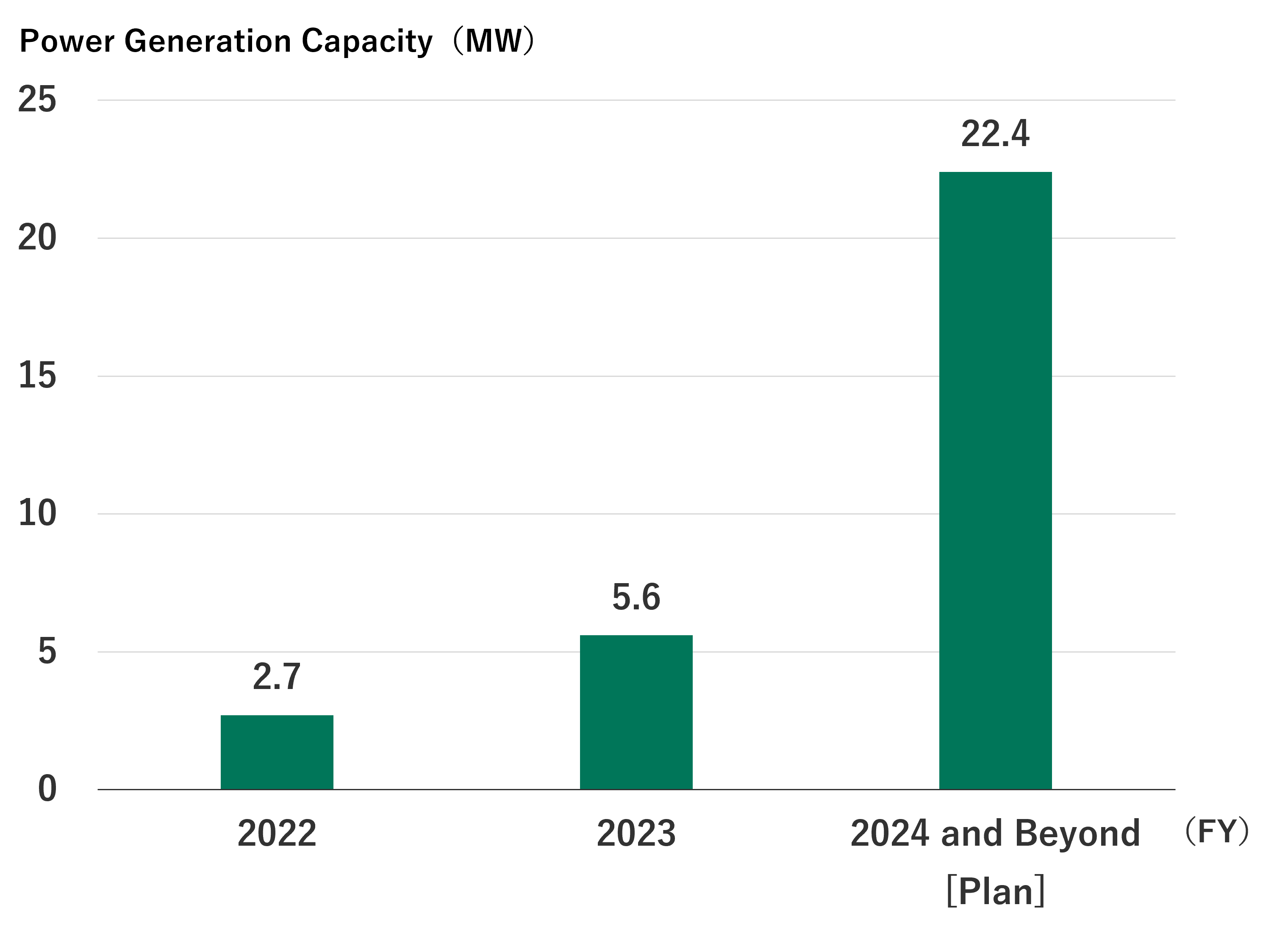

Yamato Steel has introduced a 3MW-scale solar power generation facility and system, as well as SVC (static reactive power compensation devices used for voltage flicker countermeasures, etc.), to expand the adoption of renewable energy in the future.

Additionally, SYS operates a solar power generation facility with a capacity of 7.2 MW, achieving an annual power generation of 6.6 GWh in FY2024, resulting in an annual reduction of 3,100 t-CO2.

Solar power generation equipment on roof(SYS)

<Solar Power Generation in Operation (FY2024)>

- Yamato Steel :Installation on factory roof 3MW

- Yamato Trackwork System :Installation on factory roof 185kW

- Siam Yamato Steel :Installation on factory roof 7.2MW

- Siam Yamato Steel :Water-based solar power generation project 12MW

<Installation plan for FY2025 and beyond>

Trends in Power Generation Capacity