Corporate Governance

Basic Concept

The Company recognizes that corporate governance is "to clarify the fairness, transparency, and legality of corporate decision-making and responsibility systems to shareholders and society" and regards it as an important management issue. To live up to the trust and expectations of all stakeholders, we are committed to the following basic policies.

Policy

Basic Policy

- We will strive to respect the rights of shareholders and ensure their equality.

- We will consider the interests of our stakeholders, including our shareholders, and strive for appropriate cooperation with them.

- We will strive to ensure the appropriate disclosure and transparency of corporate information.

- We will strive to appropriately execute the roles and responsibilities of the Board of Directors to ensure transparent, fair, prompt, and decisive decision-making.

- We will strive to engage in constructive dialogue with shareholders who have investment policies that are consistent with the medium- and long-term interests of shareholders.

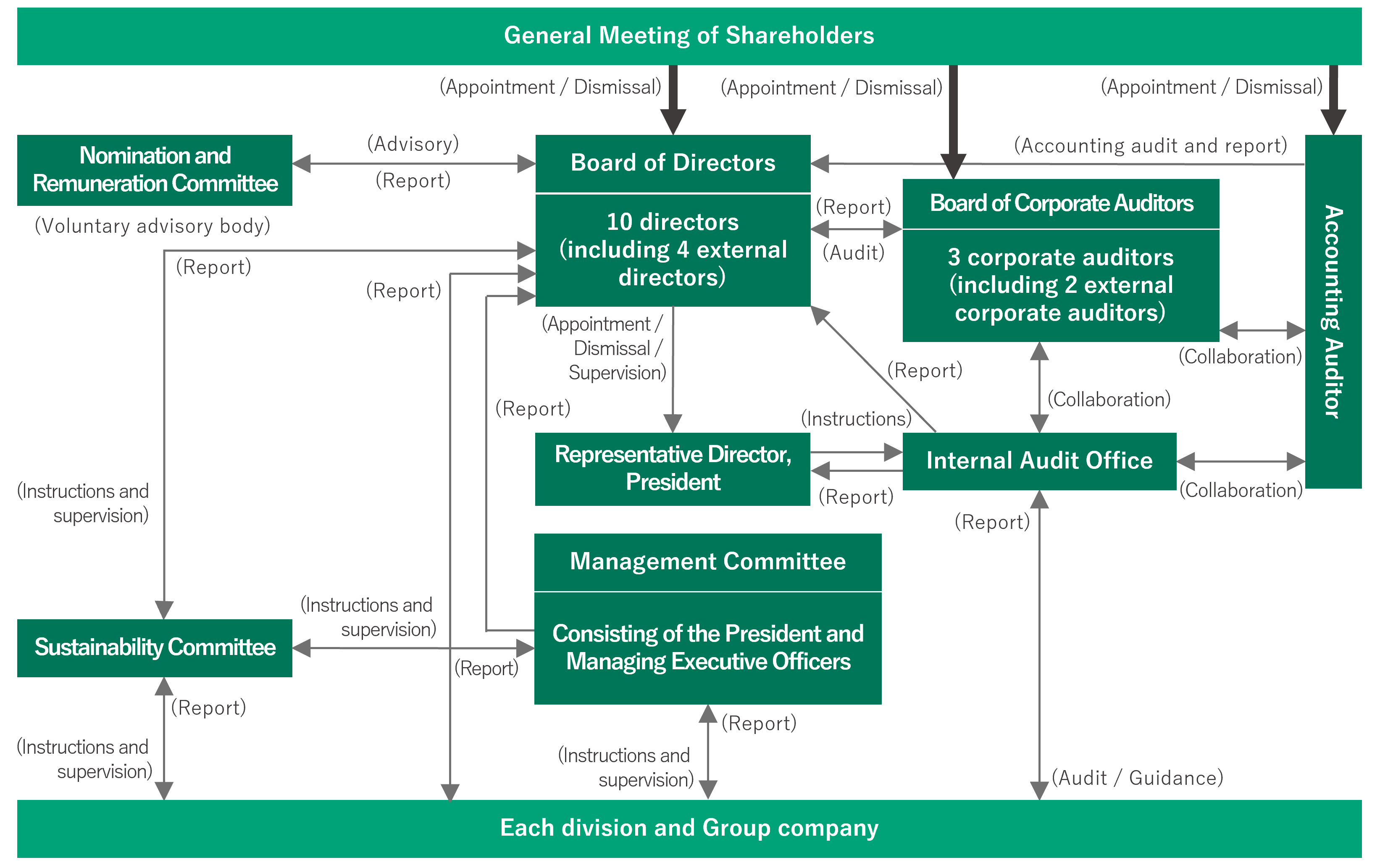

Corporate Governance Structure

The Board of Directors, which includes four external directors, makes decisions on management policies, etc., and supervises the execution of business operations, and the Board of Corporate Auditors audits the execution of duties by directors. The Company has also established the Nomination Committee and the Compensation Committee as advisory bodies to the Board of Directors to enhance corporate governance.

Members per Institution (as of November 2025) and Attendance Rate in FY2024

| Name | Independence | Board of Directors | Board of Corporate Auditors | Management Committee | Nomination Committee and Remuneration Committee | Sustainability Committee | |

|---|---|---|---|---|---|---|---|

| Chairman | Hiroyuki Inoue | 6/6 times | |||||

| Representative Director, President | Mikio Kobayashi | ◎ 6/6 times | ◎ 13/13 times | ◎ 4/4 times | |||

| Representative Director, Managing Executive Officer | Kazuhiro Tsukamoto | 6/6 times | 13/13 times | 8/8 times*1 | 4/4 times | ||

| Director Executive Officer | Nobuo Oki | 4/4 times*2 | |||||

| Director | Damri Tunshevavong | 6/6 times | |||||

| Director | Takenosuke Yasufuku | 6/6 times | 4/4 times | ||||

| External Director | Kiyoshige Akamatsu | ○ | 6/6 times | ◎ 12/12 times | 4/4 times | ||

| External Director | Kunitoshi Takeda | ○ | 6/6 times | 12/12 times | 4/4 times | ||

| External Director | Motomu Takahashi | ○ | 6/6 times | 12/12 times | 4/4 times | ||

| External Director | Pimjai Wangkiat | ○ | 6/6 times | ||||

| Auditor | Kengo Nakaya | 6/6 times | 12/12 times | ||||

| External Auditor | Shigeaki Katayama | ○ | 6/6 times | ◎ 12/12 times | 12/12 times | ||

| External Auditor | Mikio Nakajo | ○ | 6/6 times | 12/12 times |

- ◎ Indicates the chairperson or committee chairperson.

- *1 Mr. Kazuhiro Tsukamoto was appointed as a Nomination and Remuneration Committee member on September 1, 2024. Accordingly, the attendance record reflects his participation in the Nomination Committee and Remuneration Committee held after his appointment.

- *2 Mr. Nobuo Oki was appointed as a Director at the Ordinary General Meeting of Shareholders held on June 25, 2024. Accordingly, the attendance record reflects his participation in the Board of Directors held after his appointment.

Corporate Governance Structure

Board of Directors

The Board of Directors consists of 10 directors (four of whom are external directors), and holds regular meetings four times a year in principle, with extraordinary meetings held as necessary. The Board of Directors monitors and supervises the status of business execution by the directors by deliberating on matters stipulated in laws and ordinances, the Articles of Incorporation, and the Board of Directors Regulations, in addition to reports on business execution by the directors in charge, and by exchanging questions, proposals, and opinions among the directors. The Company's Articles of Incorporation stipulate that the Board of Directors may adopt resolutions based on written resolutions with the consent of all directors.

Board of Corporate Auditors

The Board of Corporate Auditors consists of three members: two full-time corporate auditors (one of whom is an external corporate auditor) and one part-time corporate auditor (an external corporate auditor). In cooperation with external directors and the Internal Audit Office, they audit the decision-making process of the Board of Directors and the status of business execution by directors.

Management Committee

It is attended by the President, and two Directors and Managing Executive Officers, as well as, if necessary, relevant directors and corporate auditors, including external directors. It is responsible for decision-making on matters entrusted by the Board of Directors (excluding matters exclusively decided by the Board of Directors as stipulated in the Companies Act), as well as deliberating, deciding, and managing policies and plans for business execution. In addition to decision-making on matters entrusted by the Board of Directors (excluding matters exclusively decided by the Board of Directors as stipulated in the Companies Act), the Board of Directors deliberates, decides, and manages policies and plans for business execution.

Nomination Committee and Remuneration Committee

The Company has established the Nomination Committee and the Remuneration Committee as voluntary advisory bodies to the Board of Directors. The purpose of the Nomination Committee and the Remuneration Committee, as voluntary advisory bodies to the Board of Directors, is to enhance the transparency and objectivity of the decision-making process of the Board of Directors for decisions on matters such as nomination and compensation and to strengthen corporate governance. The Committee consists of three external directors, one external corporate auditor, and one internal director selected by resolution of the Board of Directors, and is chaired by an external director.

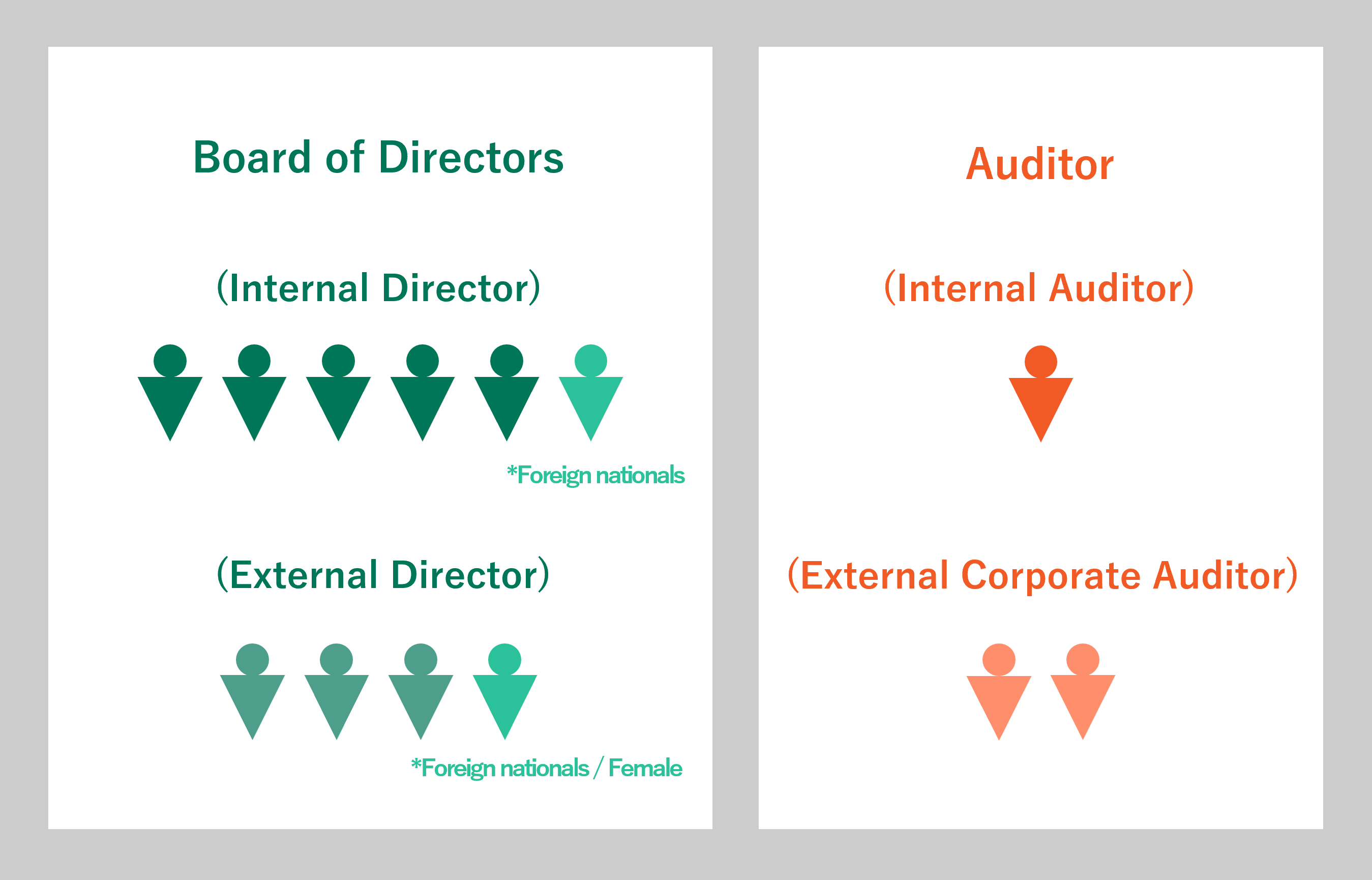

Officers

The Company's Board of Directors consists of 10 directors, including four external directors (including one foreign male and one foreign female), each with a wealth of knowledge and experience in corporate management and international business development, regardless of nationality, race, or gender, and we believe that the Board functions well as an effective Board of Directors.

The Board of Corporate Auditors consists of three corporate auditors, including two external corporate auditors. One of the corporate auditors has sufficient knowledge of finance and accounting, and one of the corporate auditors is an attorney at law with sufficient knowledge of legal matters.

Composition of the Board of Directors and Board of Corporate Auditors

Nomination and Election Policy and Dismissal Criteria for Directors and Corporate Auditors

The policies and procedures of the Board of Directors for the election and dismissal of senior management and the nomination and dismissal of candidates for Directors and Corporate Auditors are as follows.

- Policies and procedures for the appointment of candidates for directors and corporate auditors, including senior management

<Director>

(Policy)

The applicant must meet the following criteria.- (1) A person who fully understands and can put into practice the "Management Philosophy," "Management Policy," and "Employee Code of Conduct".

- (2) A person who has a strong will to maximize shareholder value and corporate value and who can exercise strong leadership to that end.

- (3) Those with practical insight and mature business judgment skills

- (4) A person with a high level of ethics, integrity, and values

The Nomination Committee, chaired by an external director, deliberates on this matter and resolves the matter at a meeting of the Board of Directors.

<Corporate Auditor>

(Policy)

The applicant must meet the following criteria.- (1) A person who has excellent character, insight, and high ethical standards, and who can fulfill the responsibilities of his/her position.

- (2) A person who can secure independence from business executors and maintain a fair and unbiased attitude.

- (3) At least one person with sufficient knowledge of finance and accounting

The Nomination Committee, chaired by an external director, deliberates on these matters, and after obtaining the consent of the Board of Corporate Auditors, the Board of Directors passes a resolution. - Policies and procedures for dismissal of directors and corporate auditors, including senior management

(Policy)

If any one of the following criteria is met, the proposal for dismissal will be made.- (1) A socially reprehensible relationship with antisocial forces is recognized.

- (2) Violation of laws, regulations, the Articles of Incorporation, or other Group regulations, causing significant loss or business disruption to our Group.

- (3) Significant impediment to the execution of duties.

- (4) Each requirement of the appointment criteria is no longer met.

If circumstances arise that require the dismissal of a Director, Corporate Auditor, or senior management member, the Nomination Committee shall deliberate the matter promptly, and the Board of Directors shall take into consideration the results of such deliberation and pass a resolution for the dismissal of the Director, Corporate Auditor, or senior management member, respectively. The dismissal of directors and corporate auditors is carried out following the provisions of the Companies Act, etc.

The reasons for the election and dismissal of directors, corporate auditors, and senior management will be disclosed as necessary, such as in the reference materials of the notice of the general meeting of shareholders.

Medium-term Sustainability Plan "Governance"

| Materiality | Item | FYE March 2026 | FYE March 2026 |

|---|---|---|---|

| Medium-term targets | Annual targets | ||

| Corporate management base | Governance |

|

|

Evaluating the Effectiveness of the Board of Directors

We conduct surveys (questionnaires) of each director and corporate auditor regarding the operation of the Board of Directors, utilizing a third-party organization. Based on the results, multiple discussions are held among the directors and corporate auditors, and it is reported to the Board of Directors that there are no problems with the operation of the Board of Directors and that its effectiveness is ensured.

The questionnaires to date have made recommendations on the composition of the Board of Directors, further enhancement of discussions on management policy (direction of growth strategy, etc.), further enhancement of discussions on business strategy, financial strategy, and human capital management, and consideration of an incentive-based executive remuneration system, and we have implemented measures such as ensuring diversity of the Board of Directors, speeding up and enhancing discussions and decision making by dividing the functions of the Board of Directors and the Management Committee, formulation of a human resources strategy aligned with Vision 2030 and introducing performance-linked compensation, including a stock-based remuneration system.

Based on the above questionnaire, we will continue to examine ways to enhance the effectiveness of the Board of Directors and further improve governance.

Ensuring Transparency and Objectivity of Executive Remuneration

The Company has established the Nomination Committee and the Remuneration Committee, which are voluntary advisory bodies to the Board of Directors, to enhance the transparency and objectivity of the decision-making process of the Board of Directors for decisions on matters such as nomination and compensation, and strengthen corporate governance. The committee consists of three external directors, one external corporate auditor, and one internal director selected by resolution of the Board of Directors, and the committee is chaired by an external director.

The Company's policy regarding the determination of remuneration, etc. for directors (excluding non-executive directors and external directors) is as follows.

Policy for Determining Remuneration, etc. of Directors

- Remuneration of the Company’s directors (excluding external directors and part-time directors) is paid at a fixed time every month as monthly remuneration made up of fixed portion of remuneration determined based on comprehensive consideration of the responsibility to supervise management of the Company in addition to the responsibility to contribute to Group management and position, etc., and the performance-linked portion of remuneration determined according to the level of achievement of performance targets and individual evaluations, etc. The total amount of remuneration of directors was specified as being up to ¥720 million per year at the 104th Ordinary General Meeting of Shareholders held on June 29, 2023. Furthermore, at the 102nd Ordinary General Meeting of Shareholders held on June 29, 2021, as part of the review of the officer remuneration system, a decision was made to pay remuneration for the granting of restricted shares to eligible directors for the purpose of providing the Company’s Directors (excluding external directors and part-time directors) an incentive for the sustained enhancement of the Company’s corporate value and further promoting the sharing of value with shareholders, and the total amount of monetary claims paid to eligible directors under the system is specified as being up to ¥100 million per year apart from the above remuneration limit. Remuneration for granting restricted shares is allocated at a fixed time every year. The amount of remuneration of individual directors is determined within the remuneration limit resolved by the General Meeting of Shareholders by the Representative Director, President delegated by the Board of Directors based on deliberation and recommendations of the Remuneration Committee.

- The indicator for performance-linked remuneration is consolidated ordinary profit, etc. and the standard value is set based on the consolidated ordinary profit under the annual business plan, with a coefficient table being set with a minimum of 0 and a maximum of 2.0 according to annual performance. The coefficient is used as a multiplier for the standard amount of performance-linked remuneration for each position to calculate individual performance-linked remuneration every year.

- The percentages of payment of fixed remuneration, performance-linked remuneration and restricted share-based remuneration vary depending on the fiscal year’s performance and position, but are generally designed to be 50% fixed remuneration, 40% performance-linked remuneration and 10% restricted share-based remuneration.

- A voluntary Remuneration Committee chaired by an external director has been established to ensure the transparency and objectivity of determination of remuneration of directors, and the Remuneration Committee conducts reviews of the officer remuneration system (such as reviews of remuneration levels, performance evaluation KPIs and standard values) with consideration for the management environment and general remuneration levels, and deliberates upon the remuneration of directors and makes recommendations to the Board of Directors based on consultation with the Board of Directors.

Fostering a Sustainability Mindset among Directors

Our Group’s major domestic companies provide opportunities for training by inviting external lecturers and participating in external seminars as necessary to help management and supervisory personnel acquire the necessary knowledge and develop a sustainability mindset.