Basic Concept

The Yamato Kogyo Group has established company-wide targets and a promotion system to address environmental issues, Yamato Steel Co., Ltd., and Yamato Trackwork System Co., Ltd. have acquired and are operating the ISO 14001 environmental management system, an international standard, to continuously improve environmental management.

Policy

Yamato Steel Co., Ltd.

Environmental Policy

◆ Basic Philosophy

We are deeply aware of the importance of protecting the global environment for humanity's survival. We understand the substantial impact of iron and steel manufacturing on the global and local environment and aim to make continuous improvements harmonized with the environment as well as to focus on the prevention of pollution.

◆ Basic Policy

Structure

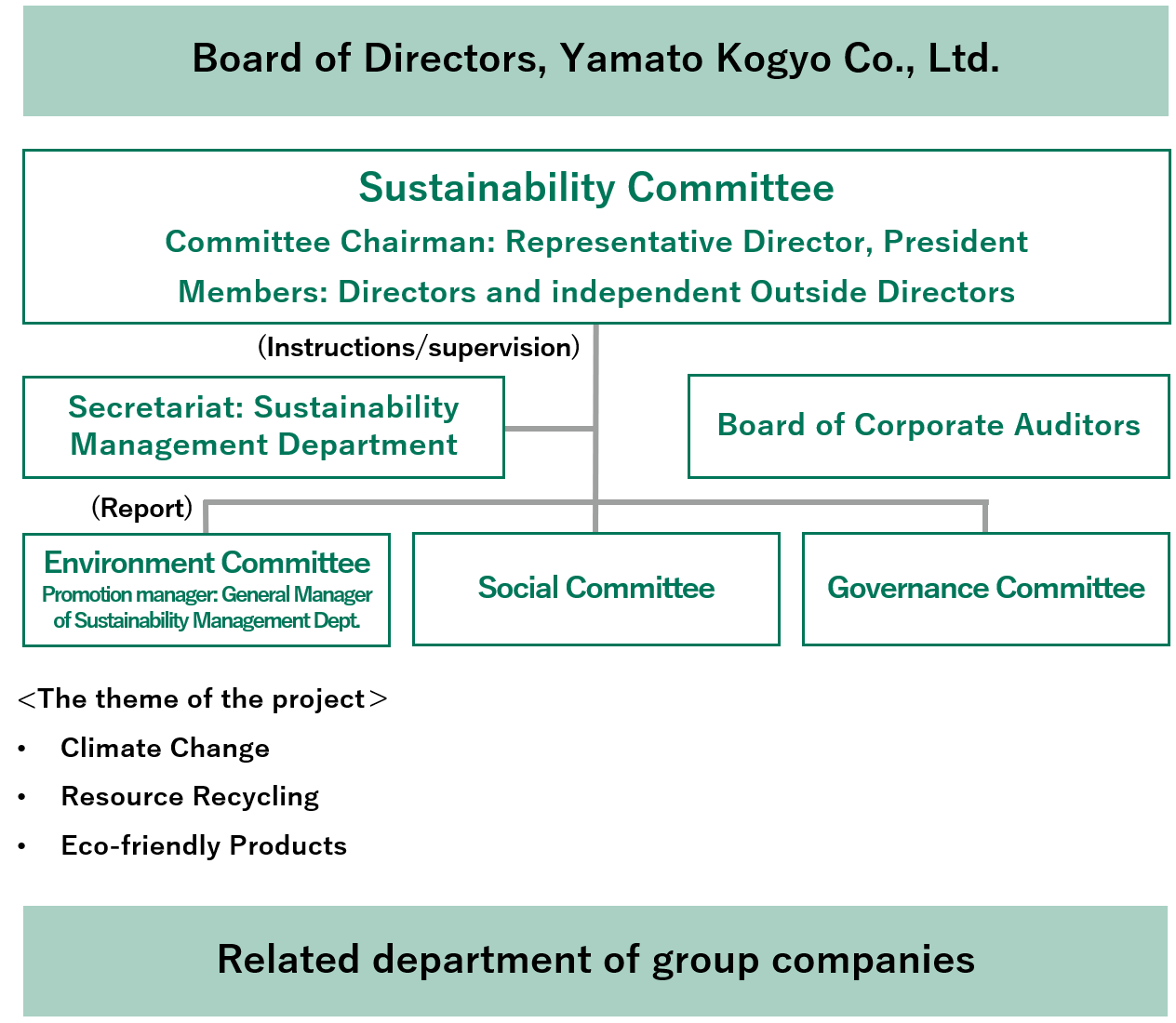

Our Group has established an Environmental Subcommittee under the Sustainability Committee chaired by the President of Yamato Kogyo Co., Ltd. to set environmental targets, check the status of achievement, and improve the environmental performance of the entire Group.

In particular, issues that are important to management, such as climate change, are discussed at the Management Committee and further reported to the Board of Directors. The Board of Directors discusses and supervises the reported environmental issues. In addition, each group company has appointed a person in charge to promote activities on a corporate basis.

Acquisition of Environmental Certification

Our major group companies in Japan have acquired ISO 14001 certification, an international certification for environmental management systems, and undergo periodic renewal audits. In addition, the Environmental Control Section conducts internal audits once a year, and the president and auditors conduct management reviews twice a year, to improve the management level.

<ISO 14001 certified factory scope>

<ISO 14001 surveillance audit results>

<Compliance audit results>

Basic Concept

Since our Group is engaged in businesses that consume a large amount of energy during manufacturing, there is a risk that various regulations and systems (carbon pricing, etc.) associated with the Paris Agreement, etc. will lead to higher costs for energy and raw materials. We also believe that the occurrence of natural disasters due to extreme weather phenomena in recent years will lead to risks such as the instability of business continuity and supply. On the other hand, we also believe that the growing awareness of climate change among society and customers provides an opportunity for our low-carbon, resource-recycling steel products to gain a competitive advantage.

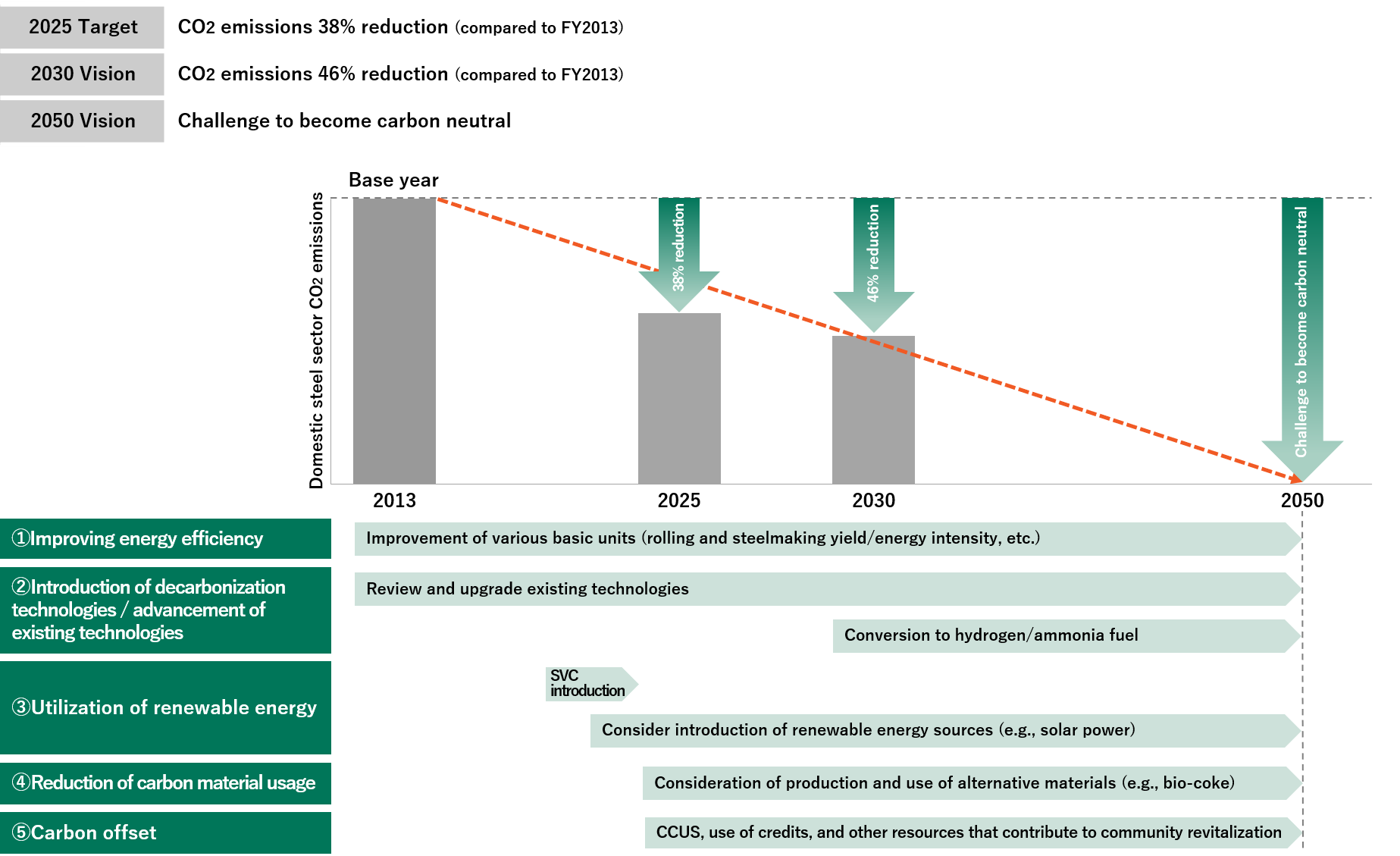

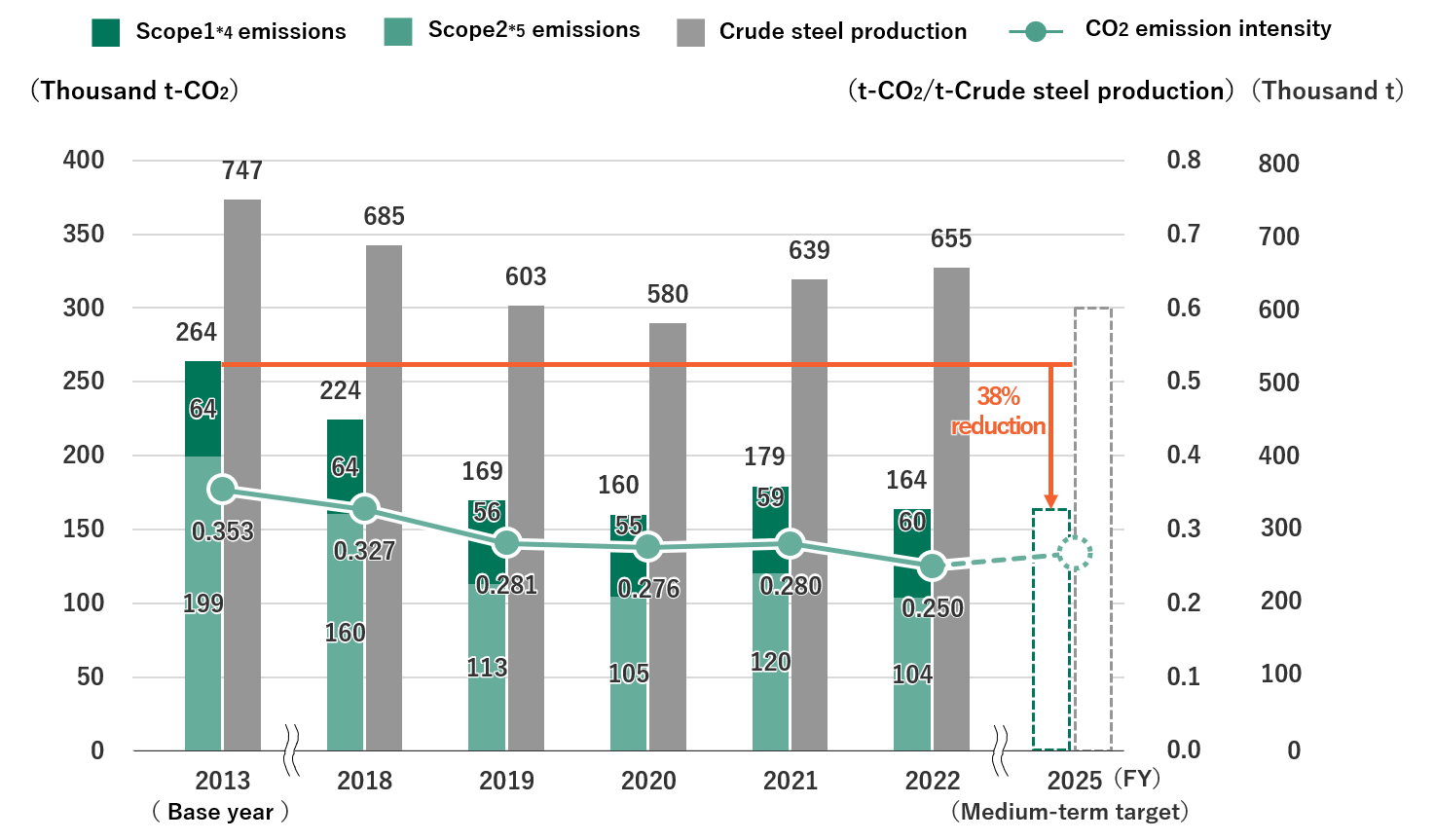

We recognize that addressing climate change issues is one of the most important themes, and we have established an Environmental Vision that challenges us to become carbon neutral by 2050 and to reduce CO2 emissions by 38% in 2025 and 46% in 2030 compared to fiscal 2013 levels.

To achieve carbon neutrality, we will promote energy conservation and consider renewable energy, alternative materials (e.g., bio-coke), and CCUS (carbon capture, utilization and storage).

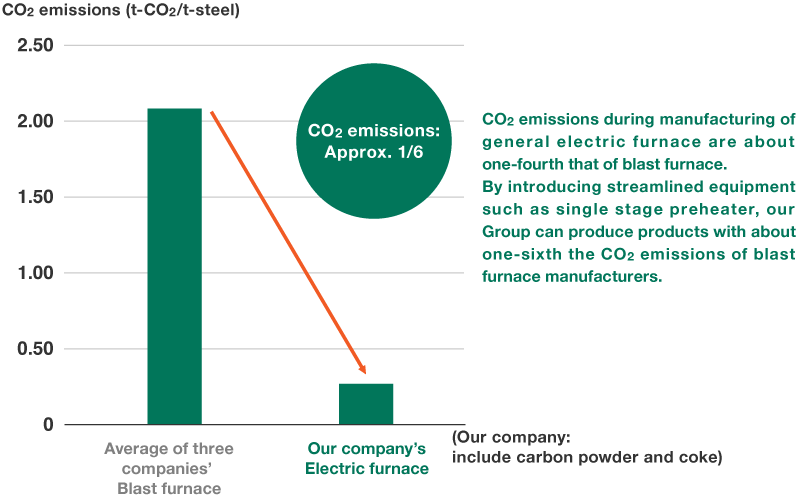

Comparison of Blast Furnace Method and Electric Furnace Method CO2 Emissions (as of February 2021)

(Source) Figures quoted from "Environmental Initiatives" and "Global Warming Countermeasures", etc. as published on company websites 2019-2021.

Domestic 2030/2050 Environmental Vision

(Note 1) Scope 1: Considers planned implementation, including innovative technological development and infrastructure improvements that are compatible with our facilities.

(Note 2) Scope 2: Considering the effect of the improvement of power coefficients and the increase in the ratio of nuclear power, renewable energy, etc. by electric power companies.

(Note 3) Although limited to domestic steel operations, steel operations account for approximately 93% of energy consumption at domestic facilities.

Response to TCFD Recommendations

In April 2022, the Yamato Kogyo group endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD was established by the Financial Stability Board (FSB), whose members include representatives of central banks and financial supervisors from 25 major countries and regions, and its recommendations for companies and organizations to disclose information on climate-related risks and opportunities. In Japan, the Ministry of Economy, Trade and Industry (METI) has published the "Guidance on Climate-related Financial Disclosures (TCFD Guidance)”, and companies have been accelerating their efforts to comply with the TCFD recommendations. In addition, the "Corporate Governance Code" revised by Japan Exchange in June 2021 also requires listed companies to disclose information based on the TCFD framework.

In light of the impact of climate change on our business, the Management Committee and Sustainability Committee of the Yamato Kogyo group have been considering climate change countermeasures in our domestic business since the FY2021. The following are the disclosures related to climate change based on the TCFD recommendations approved by the Board of Directors in April 2022.

Climate Change-related Governance Structure

Our group reports to the Board of Directors of Yamato Kogyo Co., Ltd. on a case-by-case basis on matters related to climate change issues discussed by the Environment Committee of the Sustainability Committee that meets regularly.*1 When considering business plans and annual budgets, the Board of Directors makes decisions based on the impact of climate change on business management, including risks and opportunities. The Board of Directors also checks and supervises the targets and progress regarding climate change, which the Sustainability Committee has designated as materiarity of the Medium-term Sustainability Plan.

The Sustainability Committee is chaired by Representative Director, President of Yamato Kogyo, and the Environment Committee is led by the General Manager of Sustainability Management Department.

Climate Change-related Governance Structure

Risk Management Related to Climate Change

Our group classified climate-related risks in its operations into migration risks and physical risks following the TCFD recommendations, and further assessed the risks by examining their materiality in consideration of short, medium, and long-term time horizons and relevant laws and regulations. The risk assessment was determined after review and discussion at a Management Committee attended by directors and corporate auditors.

Climate Change Related Strategies

Assumptions for scenario analysis

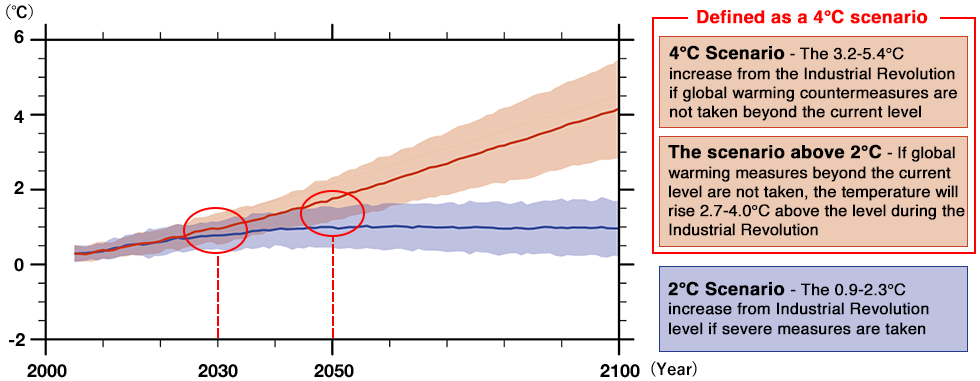

In our scenario analysis, while taking into account the Paris Agreement’s goals and the IPCC Sixth Assessment Report, we examined two scenarios: a 2℃ scenario, which is a low-carbon transition scenario, and a 4℃ scenario, which projects higher warming outcomes and more significant physical impacts. In light of the Paris Agreement's goal of "pursuing efforts to limit the increase in global average temperature to 1.5℃ above pre-industrial levels," we will continue to study transition scenarios toward the 1.5℃ goals.

Global Average Surface Temperature Change (Relative to 1986-2005)

Source: IPCC Fifth Assessment Report

Scope of scenario analysis

The scenario analysis is based on the Japanese government's greenhouse gas reduction targets (46% reduction by FY2030 and carbon neutrality by FY2050) and is conducted over a medium to long-term time horizon to 2050.

The analysis at this time is as follows.

Climate Change-related Scenario Analysis

| Scenario | Factor | Impact on Yamato Kogyo Group | Responding to Risks/Opportunities/Impacts | |

|---|---|---|---|---|

| 2℃*2 | Factor (1) Increasing demand for products that promote customer/society's effort in decarbonization and climate change The competitive environment will change as responses to climate change expand throughout the value chain and low environmental impact products and companies that tackle environmental issues are selected Infrastructure construction for disaster prevention and mitigation will proceed slowly |

|

|

|

|

|

|

||

| Factor (2) Carbon pricing Various costs such as retail electricity prices will increase due to policies and regulations (carbon pricing) |

|

|

|

|

| Factor (3) Shift of blast furnaces to electric furnaces The shift of blast furnace makers to electric furnaces will affect the procurement of raw materials, sub-materials, and energy |

||||

| Factor (4) Increasing social demands Increasing social demand for CO2 reductions will be driving a shift in materials and production processes toward low-carbon/decarbonization |

|

|

|

|

|

|

|

||

| 4℃*3 | Factor (5) Intensification of natural disasters Physical risks (flooding, property damage) at our sites and sales/procurement logistics network will become apparent Prevention and response will increase costs Heat stress during work reduces productivity and regulations will be tightened in response |

|

|

|

| Factor (6) National Resilience Disaster prevention and mitigation plans will be revised and government-led disaster response to infrastructure, etc., will spread |

|

|

|

|

Opportunity initiatives

Expansion of competitive advantage – market expansion

In Japan, the movement toward achieving carbon neutrality by 2050 is accelerating, and we expect that our customers in the construction and transportation industries will increase their procurement of products that contribute to low carbon emissions. Against this backdrop, our group has been working to expand its market through industry-leading initiatives. For example, in the area of climate change, while electric furnace makers generally emit about a quarter of the CO2 emissions per ton of blast furnace makers in their steel manufacturing processes, Yamato Steel has been introducing rationalization equipment, including the adoption of a state-of-the-art single-stage preheater (SSP) in FY2019 that achieves significant energy savings. This has enabled us to reduce CO2 emissions per ton to approximately one-sixth that of the blast furnace method, giving us a competitive edge in the electric furnace industry. In addition, while the selection of companies that produce products with low environmental impact is expected to be selective, we have taken steps such as becoming the first company in the Japanese steel industry to obtain two types of environmental certifications, "EcoLeaf" and "Carbon Footprint of Products". We will continue to address climate change and expand our market by capturing business opportunities through our competitive advantage.

See also below for our group's competitive advantages and initiatives in climate change.

Realizing a Circular Economy with Steel

Risk initiatives

Efficient energy use

A large amount of electric power is indispensable for our group's business. We recognize that future trends in energy policy and laws and regulations will have a significant impact on our operating costs if retail electricity prices increase. To date, our group has implemented a variety of initiatives for the efficient use of energy, ranging from the introduction of equipment to fuel conversion and the establishment of technologies. These efforts have produced results not only in terms of total CO2 emissions but also in terms of CO2 emission intensity per ton of crude steel produced. Against the backdrop of growing social demands for further decarbonization in the future, we believe that the following past, present, and future initiatives of our group will lead to risk reduction.

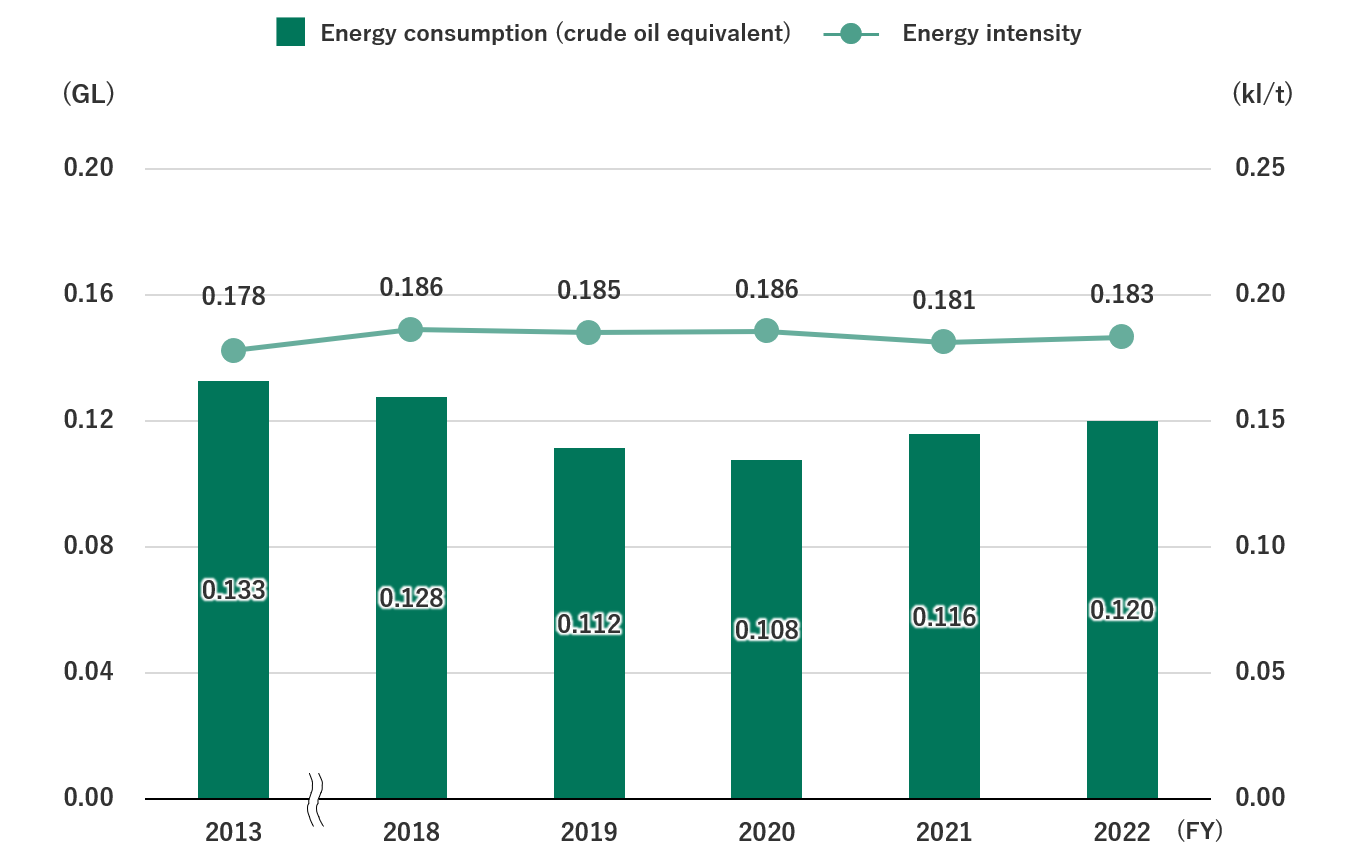

As a result of these efforts, energy consumption in FY2022 was 0.12 GL and energy intensity was 0.183 kL/t-crude steel production.

Energy Consumption and Intensity

Indicators and Targets

Based on the scenario analysis, we set medium-term and annual targets as climate change-related indicators and targets in the Medium-Term Sustainability Plan, and the Sustainability Committee monitors and verifies progress and reports to the Board of Directors. The emissions reduction target has been set to a target of 38% reduction from the 2013 level for Scope 1 and 2, targeting 2025, taking into consideration the characteristics of our group's business, past initiatives, and future social trends.

CO2 Emissions and CO2 Emission Intensity (5-year trend)

(Note 1) Data cover domestic iron and steel products business. Because the electric furnace business is characterized by heavy use of electric power, it would be significantly impacted by any change in the generation mix of electric power companies.

(Note 2) Calculated based on METI, "Action the Rational Use of Energy".

Medium-term Sustainability Plan “Climate Change”

| Materiality | Item | FYE March 2026 | FYE March 2024 |

|---|---|---|---|

| Medium-term targets*6 | Annual targets*6 | ||

| Climate change | Response to Climate change risks | We will disclose to the market financial impact from transitional and physical risks relating to climate change in the period to FYE March 2026. |

|

| Reduction of greenhouse gases ("GHG") emissions | We will reduce CO2 emissions by 38% from the FYE March 2014 level.*7*8 |

|

|

| Efficient energy use | We will reduce CO2 emission intensity by 20% from the FYE March 2014 level.*7*8 |

|

|

| Use of renewable energy | We will introduce renewable energy in specified business areas by FYE March 2026. |

|

CO2 Emissions of Yamato Kogyo Group

Energy-related CO2 emissions (FY2022)

(Unit: Thousand t-CO2)

| Scope1 | Scope2 | Scope1+2 | |

|---|---|---|---|

| Steel business (Japan) | 60.13 | 103.52 | 163.65 |

| Trackwork system business | 0.07 | 1.14 | 1.21 |

| Other | 11.34 | 0.41 | 11.75 |

| Total domestic sites | 71.54 | 105.07 | 176.61 |

| Steel business (Thailand) | 95.04 | 258.44 | 353.48 |

| Total | 166.58 | 363.51 | 530.08 |

Basic Concept

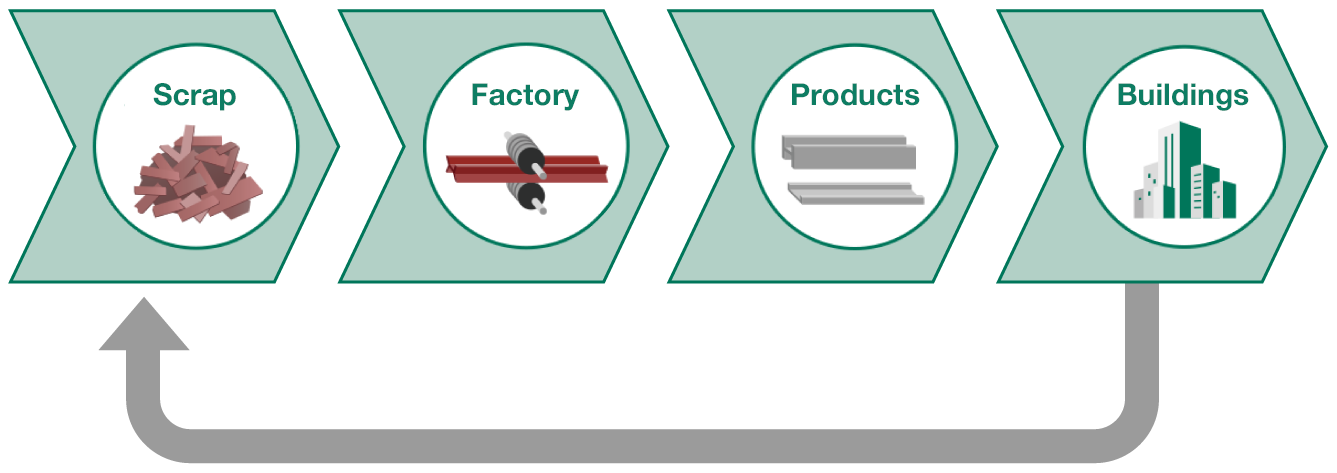

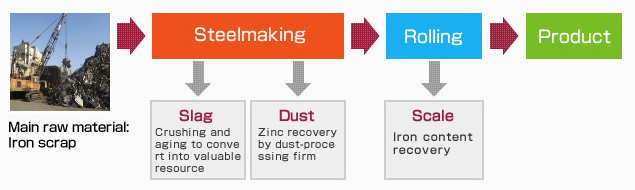

Iron is a material with exceptional recyclability. We use steel scrap as raw material, melt it in an electric furnace to remove impurities, refine it into crude steel, and then roll it to produce steel products. We will contribute to the realization of a sustainable society by enhancing and expanding systems that facilitate efficient recycling of steel scrap and realizing a sound material-cycle society (circular economy).

Feature: Realizing a Circular Economy with Steel

Medium-term Sustainability Plan "Resource Recycling"

| Materiality | Item | FYE March 2026 | FYE March 2024 |

|---|---|---|---|

| Medium-term targets*1 | Annual targets*1 | ||

| Resource recycling | Cyclic use of resources |

|

|

The Challenge to Achieve Zero Waste (Zero Emissions)

Our Group reuses used steel scrap as the main raw material and recycles waste materials such as slag, dust, scale and other waste generated in the manufacturing process. Some of the slag generated in the steelmaking process at Yamato Steel is crushed and aged in-house and sold to recycling companies as valuable resources.

In FY2022, in compliance with the guidelines, we began selling some of our waste as valuable resources instead of disposing of it in landfills, and are steadily working toward our mid-term goal of a 5% increase in the industrial waste recycling rate.

About the management of slag and slag products, we are striving for the proper management of steel slag products by preparing and complying with a management manual following the "Guidelines for the Management of Iron and Steel Slag Products" established by the Nippon Slag Association.

The Flow of Iron Recycling

Basic Concept

To achieve a higher level of environmental conservation, our group is focusing on reducing the emission of pollutants into the air and water environment by proactively incorporating diverse technologies in our business activities such as product research, development, and recycling. In addition, we have established a system to make every employee strongly aware of the necessity of global environmental harmony for business continuity through introductory environmental training at the time of joining the company and regular environmental education. In addition to complying with environmental conservation treaties, laws, and regulations, we are working to prevent abnormalities through standardized actions and the introduction of automated equipment.

Prevention of Air Pollution

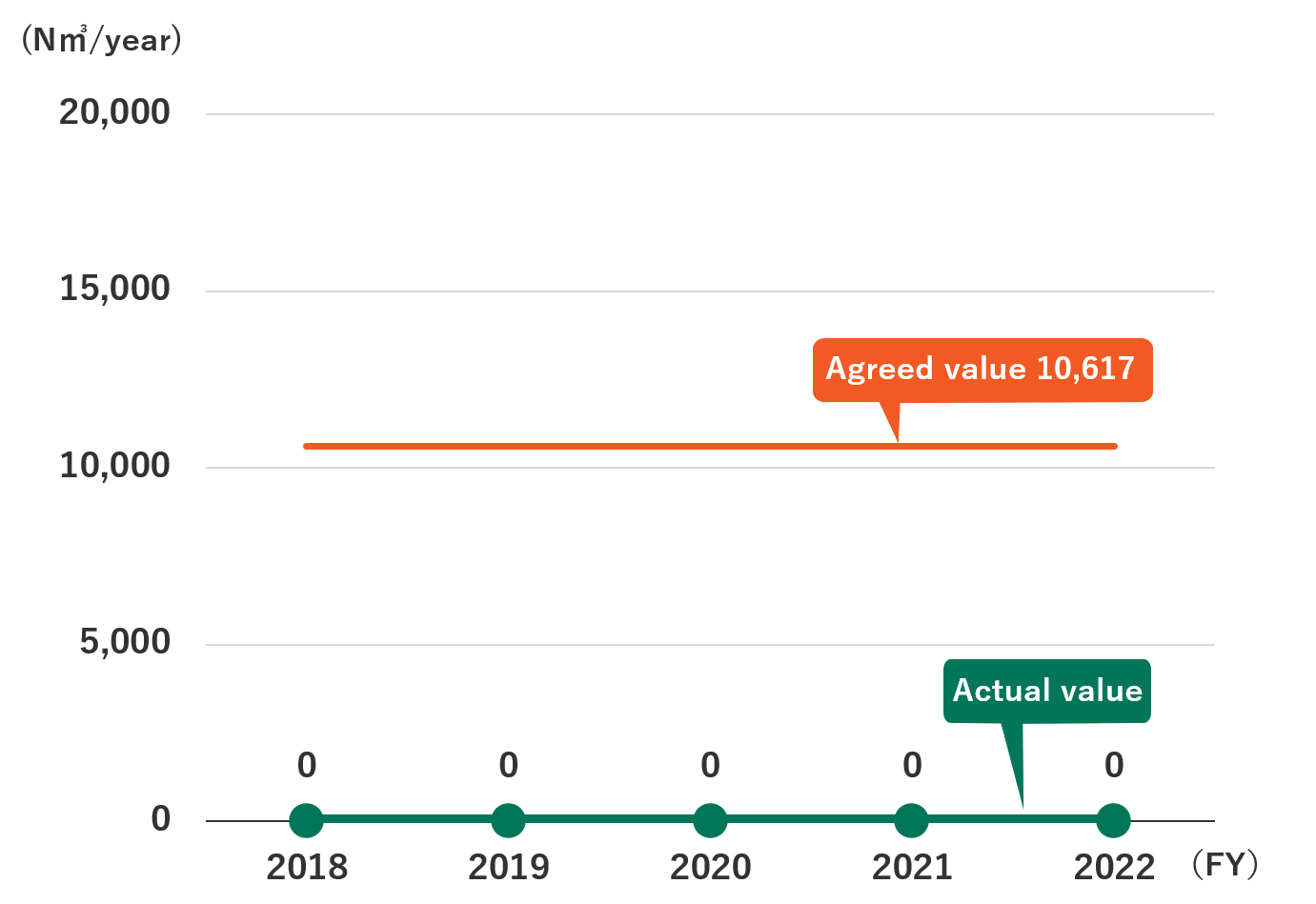

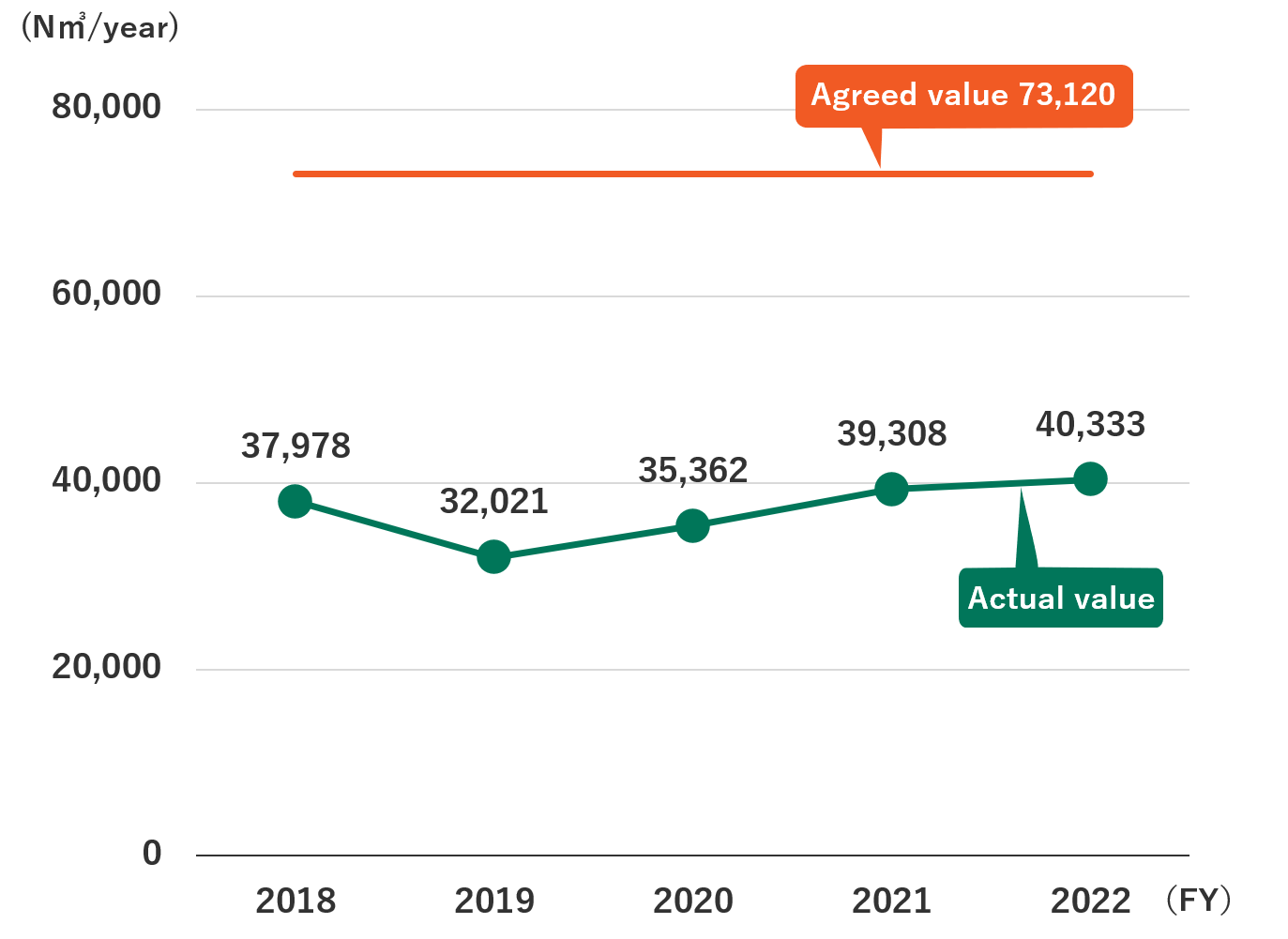

Our Group has been striving to prevent air pollution by introducing efficient equipment and fuels, etc. SOx emissions have not only been below the agreed value for the past five years but have also remained at zero. In fiscal 2021, NOx emissions increased from the previous year but remained below the agreed value.

SOx Emissions

NOx Emissions

Preservation of the Water Environment

Our Group filters and circulates industrial water for use to minimize the amount of wastewater discharged without wasting precious water resources. We are also actively working to reduce the environmental impact of domestic wastewater by treating it with bacteria before discharging it.Since there is a risk of oil spillage from the plant into public waters (rivers, etc.), the management of drainage gate had been maintained by human checks, but now we are striving to preserve the water environment by installing oil and pH detectors and introducing automated technology that automatically opens and closes the gates according to the detection status.

<Use of alternative water sources>

We have replaced conventional industrial water sprinkling with rainwater storage water as a measure to prevent dust dispersion during the summer. (Implemented in the summer of FY2022)

(Fiscal year)

| Item | Agreed value | 2018 | 2019 | 2020 | 2021 | 2022 | |||

|---|---|---|---|---|---|---|---|---|---|

| Water withdrawals, discharges, and consumption | Water withdrawals – total volume | Freshwater | ML/year | - | 1.46 | 1.38 | 1.36 | 1.46 | 1.43 |

| Intensity | L/t-crude steel production | - | 2.1 | 2.3 | 2.4 | 2.3 | 2.2 | ||

| Water discharges – total volume | Total volume | ML/year | - | 0.50 | 0.48 | 0.60 | 0.63 | 0.58 | |

| Water consumption – total volume | Freshwater | ML/year | - | 0.96 | 0.90 | 0.77 | 0.83 | 0.85 | |

| Intensity | L/t-crude steel production | - | 1.4 | 1.5 | 1.3 | 1.3 | 1.3 | ||

| Water quality | Total wastewater volume (m³/day)*1 | Usual*2 | 2,708 | 1,504 | 1,395 | 1,734 | 2,107 | 1,617 | |

| Maximum*3 | 3,230 | 2,245 | 2,083 | 2,306 | 2,735 | 1,982 | |||

| Hydrogen ion concentration (pH) | Smallest*4 | 5.8 | 6.5 | 6.5 | 6.6 | 6.4 | 7.0 | ||

| Maximum | 8.6 | 8.0 | 8.1 | 8.1 | 8.5 | 8.3 | |||

| Chemical oxygen demand (COD) | Concentration | Maximum (mg/L) | 30 | 3.3 | 5.1 | 3.5 | 4.2 | 3.5 | |

| Standard (mg/L) | 6.6 | 2.7 | 2.8 | 2.3 | 2.5 | 2.3 | |||

| Load carrying capacity | Maximum (kg/day) | 22 | 5.7 | 7.0 | 6.3 | 9.6 | 6.1 | ||

| Standard (kg/day) | 18 | 4.0 | 3.7 | 4.0 | 5.2 | 3.7 | |||

| Biochemical oxygen demand (BOD) | Concentration | Standard (mg/L) | - | < 0.5 | < 0.5 | < 0.5 | 1.1 | 1.4 | |

| Suspended solids (SS) | Concentration | Maximum (mg/L) | 60 | < 1 | 2 | 3 | 2 | 1 | |

| Standard (mg/L) | 22 | < 1 | < 1 | 1 | 1 | 1 | |||

| Load carrying capacity | Maximum (kg/day) | 72 | 2.2 | 2.1 | 6.5 | 4.0 | 2.0 | ||

| Standard (kg/day) | 60 | 1.5 | 1.4 | 2.5 | 2.3 | 1.6 | |||

| n-Hex | Concentration | Standard (mg/L) | - | < 0.5 | < 0.5 | < 0.5 | < 0.5 | < 0.5 | |

Proper Management of Chemical Substances

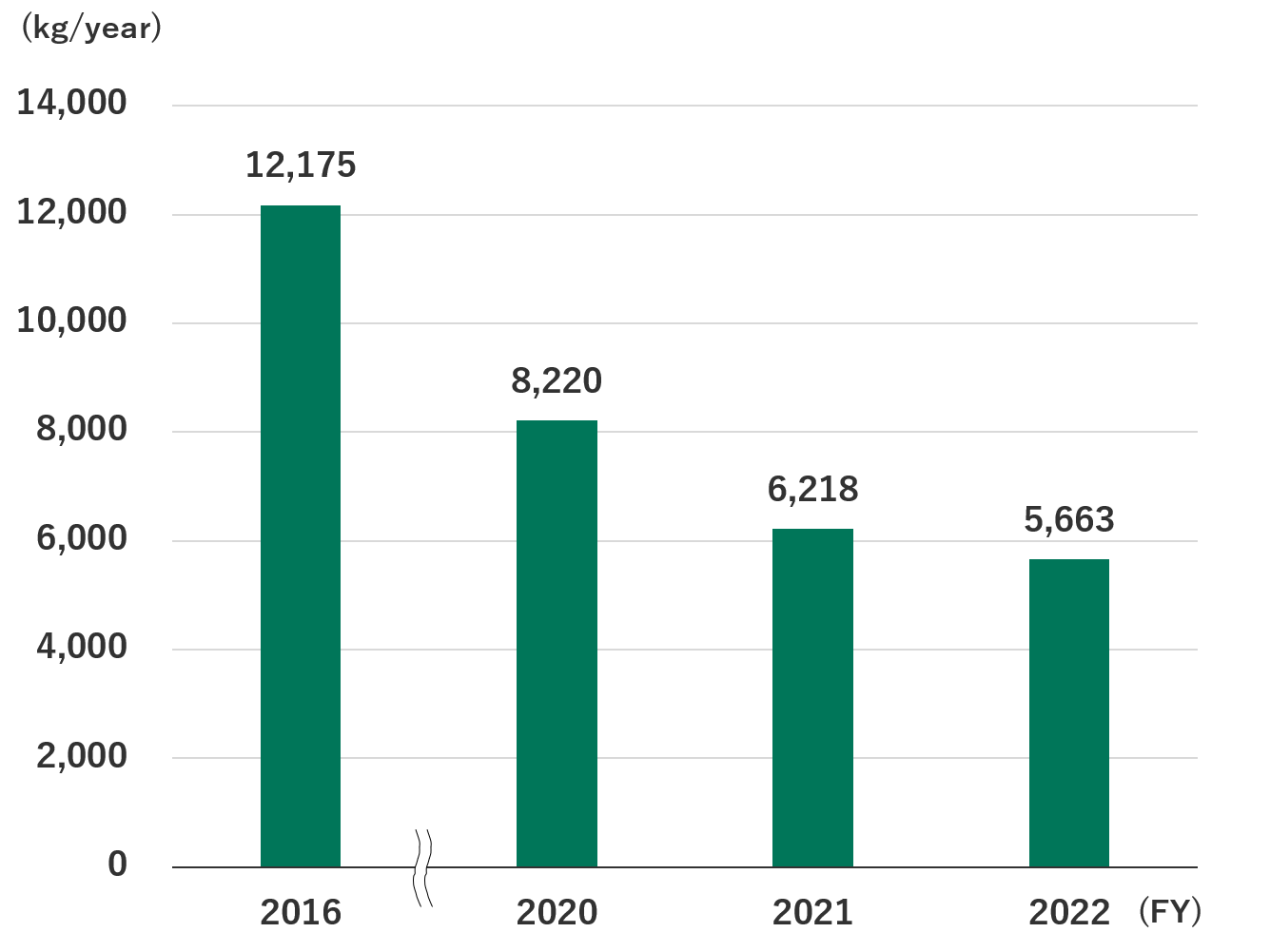

The chemical substances released by our Group are properly managed following the Law of Pollutant Release and Transfer Register*1, SDS*2, and other related laws and regulations. In addition to complying with the regulatory values, we are also working to reduce them.

Amount of PRTR Substances Released and Transferred

| PRTR substance number | Chemical name | Purpose of use | Amount handled (kg, ng-TEQ/m³) | Emissions to the environment (kg, ng-TEQ/m³) | Amount of travel outside the office (kg/year) | Chemical Substances Control Law notification or not | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Emissions to the atmosphere | Discharge into public waters | Discharge to the soil at the relevant business site | Landfill disposal at the relevant business site | Waste | Drainage | |||||

| 80 | Xylene | Paint solvent / Fuel | 3,318 | 3,318 | 0 | 0 | 0 | 0 | 0 | Yes |

| 87 | Chromium and trivalent chromium compounds | Reduced slag / Rolling sludge / Casting steel mold | 2,895 | 0 | 0 | 0 | 0 | 2,895 | 0 | Yes |

| 296 | 1,2,4-Trimethylbenzene | Paint solvent / Fuel | 3,323 | 3,323 | 0 | 0 | 0 | 0 | 0 | Yes |

| 300 | Toluene | Paint solvent / Fuel | 1,195 | 1,195 | 0 | 0 | 0 | 0 | 0 | Yes |

| 412 | Manganese and its compounds | Reduced slag / Rolling sludge / Casting steel mold | 41,979 | 0 | 0 | 0 | 0 | 41,979 | 0 | Yes |

| 243 | Dioxins | Unintentional product | 124 | 124 | 0 | 0 | 0 | 0 | 0 | Yes |

VOC Emissions

(Note) The above covers volatile organic compounds (VOCs) related to our group among the chemical substances specified in the Order for the PRTR Act as VOCs.

Basic Concept

In addition to reducing the environmental impact of our business activities, we also aim to reduce the environmental impact of our products throughout their entire life cycle, including when they are used and recycled at our customers' sites. By acquiring external environmental certifications such as the "EcoLeaf" and "Carbon Footprint of Products (CFP)", we believe that we can be easily selected by our customers and thus contribute to reducing the environmental impact of society as a whole.

Medium-term Sustainability Plan "Eco-Friendly Products"

| Materiality | Item | FYE March 2026 | FYE March 2024 |

|---|---|---|---|

| Medium-term targets*1 | Annual targets*1 | ||

| Eco-friendly products | Development of eco-friendly products and services | We will contribute to the reduction of CO2 emissions by society as a whole by promoting the use of environmentally certified products and supplying products with low CO2 emissions. |

|

Development of Eco-friendly Products and Services

Although steel is a material that can be recycled semi-permanently, the entire life cycle of steel, including manufacturing, distribution, use, disposal, and recycling, has an environmental impact, such as the generation of CO2. Our group has acquired environmental certification to produce eco-friendly products and services with reduced environmental impact and to allow our customers to make objective judgments. We will continue to maintain reliability and transparency while balancing the environment and management.

Obtaining Eco-label Certification

Yamato Steel has acquired two types of environmental declaration certification, the EcoLeaf, and the Carbon Footprint of Products (CFP), from the Sustainable Management Promotion Organization, for six of its products*, including H-beams. Yamato Steel is the first company in the steel industry in Japan to acquire these two types of certifications.

In the future, we will further expand our recognition through sales activities and actively promote the development and diffusion of eco-friendly products.

What is the EcoLeaf?

Website of Sustainable Management Promotion Organization (SuMPO)

What is the CFP?

CFP is an abbreviation for Carbon Footprint of Products.

CFP is one of the systems to convert greenhouse gases emitted during the entire product life cycle into carbon dioxide emissions and quantify them to realize a low-carbon society.

This system can be used as an incentive for both businesses and consumers to take action to reduce greenhouse gases.